APAC Guidelines

Exports Under GST – Deemed Exports, Forms for Refunds –When we talk of exports under GST, we have to understand the laws and regulations applicable to the import and export of both services and goods

Meaning of Import and Export of Goods under GST

Sub-Section 5 of section 2 of IGST Act, 2017 defines – “Export of Goods”, with its grammatical variations and cognate expressions, means taking out of India to a place outside India.

Sub-Section 10 of section 2 of IGST Act, 2017 defines – “import of the goods” with its grammatical variations and cognate expressions, means bringing goods into India from a place outside India.

Meaning of Import and Export of Services under GST

“Import of Services” as defined under sub-section 11 of section of IGST Act, 2017 means the supply of any service, when –

The place of supply of service is in India

The supplier of service is located outside India;

The recipient of service is located in India; and

Supplies which do not form part of export of goods or services

Where the place of supply of service is within India but to a person located outside India. For an instance – a property located in Delhi rented out to a person residing in New York; agent residing in India and providing service to a person in Dubai exporting goods to China.

Where the consideration for the supply of services is received in Indian currency or in such a currency other than convertible currency. For an instance, supply of service (consultancy service) by a consulting firm in India to an entity outside India, where the payment made by Indian branch of overseas entity is in Indian rupees.

Supply of services to the foreign branch would not be covered as export of services due to specific exclusion as “export of service”. This could involve reversing the input credits as such supply of service would be considered as non-taxable and not as zero-rated.

The definition of import of service given under GST also excludes services imported from a foreign branch.

Deemed Exports under GST

Indian suppliers of services and manufacturers of goods have to quote in competition with foreign suppliers of goods and services. Such Bids evaluation is done without considering the customs duty. Since such supply of goods and services are financed for specific projects (projects financed) with the free foreign exchange, these supplies are considered as ‘deemed exports’.

Similarly, supplies made to Export Oriented Units also known as EOUs and services do not leave the country. Suppliers get their payment in Indian currency and not in foreign exchange.

“Deemed exports” generally refer to those transactions under which supply of goods do not leave the country, and payment for such supplies is received in Indian Rupees shall be treated as ‘deemed exports’, provided that goods are manufactured or produced in India.

As per Foreign Trade Policy 2015-2020, followings are treated as deemed exports:

Supplies to EOU / STP / EHTP / BTP

Supplies against Advance Authorisation/ DFIA

Supply of goods to mega power projects against International Competitive Bidding

Supplies to United Nation Agencies

Supply of goods to nuclear projects through competitive bidding

Supply of marine freight containers

Supplies against EPCG authorization

Supplies to projects against international competitive bidding

Supplies to projects with zero customs duty

Treatment of Exports under GST

As per the provisions contained under IGST law, export of goods or services or both are to be regarded as “zero-rated supplies” and a person being a registered taxable person exporting such goods or services or both shall be allowed to claim the refund of the GST paid under one of the following two options:

Export of goods or services or both under bond or letter of undertaking (LUT) without paying any Integrated Tax and can claim the refund of unutilized input credit.

Export of goods and service or both on the payment of Integrated Tax and the exporter can claim the refund of the GST paid on such goods and services so exported. The above-mentioned refunds will be subject to certain rules, procedures, and safeguards as may be prescribed.

Option 1: Export of goods or services or both under bond or letter of undertaking (LUT), subject to certain rules, procedures and safeguards as may be prescribed, without payment of integrated tax, and then claim a refund of unutilized input credit.

The registered taxable person (or exporter) is required to file an application for the refund on the common portal either through the facilitation center notified by the GST commissioner or can do so directly. An export manifest is required to be filed under the existing Customs Act before filing an application for refund.

Option 2: Any exporter or Embassy or United Nations or other organisations/ bodies/ agencies as specified in section 55 who supplies goods or services, or both, after satisfying all the conditions, rules, procedures and safeguards as may be prescribed; and paying the IGST, can claim the refund of such GST paid on the supplied goods or services, or both. The applicant seeking the refund has to apply for the refund as per the provisions contained U/s 54 of the CGST Act.

An exporter needs to file a shipping bill for the goods being exported to a place outside India. Under this case, the shipping bill so filed is treated as a “deemed application” for the refund of the tax paid. The deemed application shall be deemed to have been filed only if the person in charge of the shipment files the export manifest or report, mentioning the number and date of the shipping bills.

Forms for Refund

The Goods and Services Tax Network (GSTN) has introduced a utility Table 6A in the Form GSTR-1 used to claim refunds by exporters.

This Table 6A of Form GSTR1 lets assessee file export related data for the relevant period that permits processing of the GST refund on the basis of the declaration made under Form GSTR 3B and Table 6A of GSTR-1.

An exporter of goods or services or both can claim the refund of Integrated GST paid at the time of export by filling the details of the tax paid GST invoice and shipping bill in his Form GSTR1 in the relevant month.

How to Claim Refund on GST paid on Exports & More

Definition of Export as per the GST Act

The IGST Act defines export as the taking out of goods or services from India to a place outside India. As per the Act, goods and services that are exported are considered “zero-rated supplies”. Taxable persons who export such goods and services are also eligible for claiming refunds on the GST paid. Thus, the GST rate is 0% for exports.

Procedure for availing GST Refund

GST has two components, central GST and state GST. Further, Integrated GST is applicable on inter-state supplies of goods and services, as well as on imports and exports of India. However, the exporter can claim a refund on the IGST charged, and this can be done using one of the two available options:

Exporting goods and services under a Letter of Undertaking or bond without paying the IGST

Under this an exporter is allowed to claim a refund on the unutilized input credit. If the refund is claimed on duty paid, the refund is quite quick and gets granted usually within a fortnight. The exporter needs to file the GSTR-1 and 3B and also file the export general manifest. No separate application is required as the Shipping Bill itself is considered as an application. The exporter files the shipping bill for goods exported outside of India. The deemed application will only be considered filed when the exporter, the Custom House Agent or whoever is in charge of the shipment has filed the export report or manifest that states the date and number of the shipping bills.

Exporting goods and services on payment of the IGST

The exporter is eligible for claiming a refund on the tax paid on such export. In case of refund claim without payment of IGST and for input credit, the exporter files a separate application online in the form of RFD-01A. A hard copy of the application along with supporting documents needs to be submitted manually to GST officials. In this case, the refund is made based on the verification of filed documents.

The exporter then has to apply for the refund through the common portal, either directly or through the facilitation centre notified by the GST Commissioner. A refund once applied has to be paid within 60 days from the date of receipt of complete refund application. Beyond that time frame, an interest of 6% has to be paid to the applicant.

Documents required for availing GST Refund

To avail the tax benefits available to the exporter under the GST regime, the exporter will have to ensure that certain formalities are fulfilled from his/her end.

While exporting goods

The exporter has to ensure certain things which include:-

- The exporter must have an Import Export Code (IEC)

- If the export is carried out without paying IGST, then a LUT or bond has to be furnished

- Purchase orders relevant to the export transaction

- The exporter will have to issue tax invoices with details such as:-

- Indication of whether the export is made with or without payment of the integrated tax

- The exporter’s address, name and GSTIN

- Number and date of the invoice

- Recipient’s name and address, along with the destination country and delivery address

- Harmonized System of Nomenclature (HSN) code of goods, along with their description

- Size and amount of the shipped goods indicating the number of units

- The sum of the value of all the goods along with a breakdown of cost per unit

- Signature of the exporter or an authorised signatory

- A shipping bill with details matching the tax invoice

- The shipping bill filed will be treated as a refund claim provided-

- The exporter carrying out the export files an export manifest

- He or she files form GSTR-3 or GSTR-3B in the appropriate manner

While exporting services

If the delivery of service qualifies as export under Section 2(6) of the 2017 IGST Act, then the following factors must be considered by the service exporter.

- If the service export is made without the payment of IGST, a Letter of Undertaking or bond must be furnished

- The exporter has to ensure the availability of a relevant service agreement, ready to be attached

- The exporter has to issue a tax invoice providing the following details-

- Endorsement describing whether the supply is meant for export with or without payment of integrated tax

- Name, address, and the GSTIN of the exporter

- Invoice number and date

- Name and address of the recipient

- HSN Code of services along with their description

- The total service value along with the stage-wise breakdown or milestones, if any,

- Signature of the exporter or the authorised signatory of the exporter

- As a proof of receipt of convertible foreign exchange, the exporter will have to maintain documents such as Bank Realisation Certificate or Foreign Inward Remittance Certificate within the given period, which could typically be a year from the date of export. If the exporter fails to do so, GST will become applicable.

Final Word

As clear from the above, exporters can claim a refund on IGST for the (i) duties paid on exports and (ii) unutilised input tax credit.

By following this documentation and procedure, a goods or services exporter can comply with the requirements of GST law and also stay on course to receive the refund on IGST.

How to furnish LUT in RFD-11 on GST Portal

All registered tax payers who export the goods or services will now have to furnish Letter of Undertaking (LUT) in GST RFD-11 form on the common portal of GSTN in order to make exports without payment of IGST.

When to apply/file?- Letter of undertaking has to be filed /submitted online before exporting the goods/services.

Prior to this , exporters had to manually submit the filled and signed RFD-11 on Business letterhead in duplicate –

- One to the Jurisdictional Deputy/Assistant Commissioner having jurisdiction over their principal place of business where the verification with the Export documents happens through ICEGATE medium

- Another along with the Export documents to the Customs clearing authority.

Just like the earlier excise regime, this led to exporters losing considerable time and operating expense on this compliance.

Eventually, this process has now been rationalised and made simple & quick, giving transparency in the entire process of exports by an exporter to all the stakeholders involved .

Note that the Furnishing of Bond has to be on a non-judicial stamp paper and so needs a manual submission.

Important Update! Furnish fresh LUT for FY 2020-21

LUT will be valid for a financial year. If LUT was furnished in FY 2019-20, then the date of expiry of the validity of such LUT is 31st March 2020. Therefore, You need to furnish fresh LUT for FY 2020-21. The time limit to furnish such LUT for FY 2020-21 is extended from 31st March 2020 till 30th June 2020.

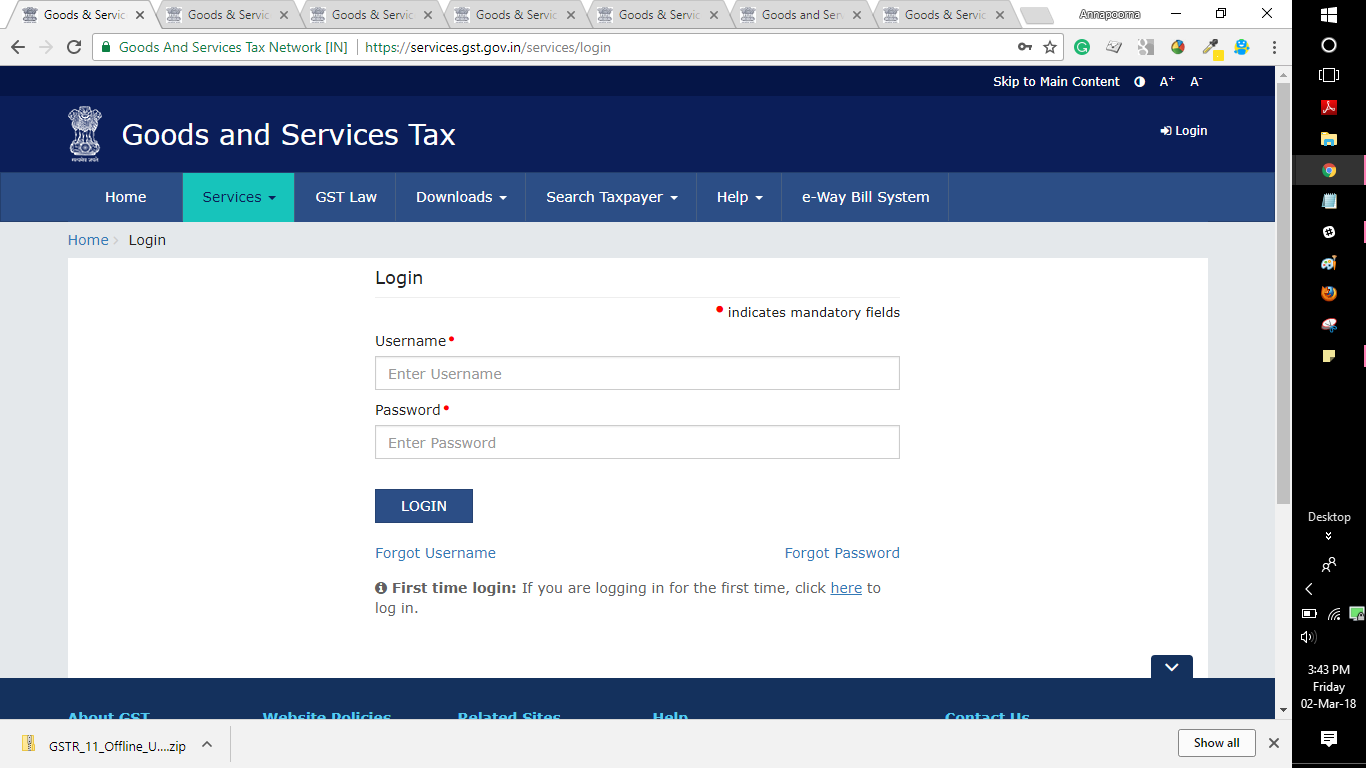

Here are the steps to be followed on GST portal/GSTN to furnish LUT :

Step 1: Login to GST Portal

Step 2: Go to ‘SERVICES’ Tab > ‘User Services’ > Select ‘Furnish Letter of Undertaking(LUT)’

Step 3: Select the financial year for which Letter of Undertaking is applied for from the ‘LUT Applied for Financial Year’ drop-down list. Eg: 2020-21

Note: If Letter of undertaking has been already furnished manually for any of the previous periods, then please upload the same by Clicking on ‘Choose File’ option on the same window.

Ensure:

- Only PDF or JPEG file formats are allowed.

- Maximum file size for upload is 2 MB

Step 4: Fill up the necessary details on the Letter of Undertaking Form/ GST RFD-11 that appears on the screen

The following needs to be done on the form:

- Self-Declaration: Tick mark by clicking against each of the three boxes

By doing this, Exporter undertakes the following :

a) Export of goods/services will be completed within a period of three months from the date of issue of Export invoice or further period allowed by the Commissioner if any.

b) To abide by GST law in respect of exports

c) To pay IGST along with Interest* if failed to Export

* Interest must be paid at the rate of 18% per annum for the period From date of issue of export invoice upto date of Payment of IGST

- Give Independent Witnesses Information: Mention the Name, Occupation and Address of two independent witnesses in the boxes highlighted in red color mandatorily.

Note that the Witnesses declared in the Letter of Undertaking (LUT) are the ones declared on the running Bond/ Bank guarantee.

Step 5: Enter the Place of filing > Click on ‘SAVE’ > click on ‘PREVIEW’ to verify the correctness of the form before submission

Note that currently, the revision of a signed/submitted form is not possible.

Step 6: Sign and file the form using either of the below options:

Who Should sign?- The Primary authorised signatory/ any other authorised signatory can sign the Letter of Undertaking.

Authorised signatory can be the working partner, the Managing Director or the Company Secretary or the proprietor or by a person duly authorised by such working partner or Board of Directors of such company or proprietor to execute the form.

- Submit with DSC: Sign the application using the registered Digital Signature Certificate of the selected authorized signatory.

To use this option, Click on ‘SIGN AND FILE WITH DSC’ > Warning message box appears > Click

‘PROCEED’> System generates a unique ARN (Application reference number)**

OR

- Submit with EVC: To use this option, Click on ‘SIGN AND FILE WITH EVC’ > The system will trigger an OTP to the registered mobile phone number and e-mail address of the authorized signatory. Enter that OTP in the pop-up to sign the application > Warning message box for submission appears > Click ‘PROCEED’> System generates a unique ARN (Application reference number)**

Note : Companies and LLPs can file only using DSC

** A confirmation message appears. GST Portal sends this ARN at registered email and mobile of the Taxpayer by e-mail and SMS.

You can click on the DOWNLOAD button to download the acknowledgement.

You may also check out the Letter of Undertakings previously furnished on the GST portal. On the home page, Go to ‘SERVICES’ > ‘ User Services’ > ‘View my Submitted LUTs’ > Select period > Check out the list of LUTs furnished during the selected period > Click ‘VIEW’ against the particular Letter of Undertaking to view the detail.