This term indicates:

(i) The time period required for transferring the contracted goods to the buyer.

(ii) Terms of delivery or INCOTERMS.

The delivery terms also define the price to be calculated for the contracted goods depending upon how the goods are to be delivered.

(i) The Time Period:

The supplier needs time to make goods ready for delivery to the importer. This time is calculated either from the date of the receipt of the detailed purchase order or the payment order likes Letter of Credit or both, from the importer.

It is generally indicated in months, ex:

Delivery: 8 months from the date of receipt of the purchase order

or

8 months from the date of receipt of the purchase order and L/C

or

8 months from the date of receipt of the L/C.

In some cases the importer may insist on calculation of the delivery period from the date of the purchase order, but mentioning in the purchase order that the L/C will be established say 2 months prior to shipment. The advantage with the importer is that his money is not blocked for the duration of the shipment period.

The disadvantage with the exporter is that till the time they receive the L/C they have to use their own funds or borrow from the bank and/or the financial institutions for meeting the raw material and other utilities requirements.

In some cases there are chances that the exporter has to import certain raw material for meeting the export production commitments. In such cases also he has to depend on the credits from the banking and/or institutions. In all such cases it is upto the exporter to agree or not to agree depending on the business potential and past record of exports to the importer.

In any case the exporter has to make sure the delivery terms at the stage of contract formation, any misunderstanding at this initial stage can result in delayed shipments and resulting penalties for delayed shipments.

(ii) Delivery Terms:

The Incoterms (The International Commercial Terms): These terms basically define the relationship between two interacting parties trying to conduct a particular transaction for the exchange of goods and services.

These terms explain the areas of risk and responsibilities of the seller and those of the buyer in relation to the carriage of the goods and services, division of the costs, and the import & export clearances at the respective ends (importers and exporters).

(a) Background:

The problems covering the carriage of goods are due to the diversity of laws, language and its interpretation across the borders. This was due mainly to the non-uniformity in understanding and interpretation or in other words there was a sense of distortion and imbalance.

The trading nations needed a sense of uniformity in meaning, interpretation and application; rather they all desired universally applicable standards out of such diversity. This prompted international actions amongst the nations to organize the most commonly used trading terms into well-defined and understood terminology so that each term meant same thing to every one dealing in the international trade.

Thus in 1936 for the first time the International chamber of Commerce ICC deliberated on this issue and set up well defined international guidelines for the interpretation of the various trading terms for bringing an order in the trade practices.

These were called the International Commercial Terms or in short the INCOTERMS. These were amended from time to time (1953, 1967, 1976, 1980, 1990) each amendment made these terms more and more fool proof. The latest amendment (INCOTERM 2020) is expected to further strengthen the interpretation and streamline the universal usage.

The major differences between the 2010 and 2020 are in FAS (export clearance obligation on exporter i/o on importer), FCA (exporter’s obligation to load the contracted goods on importer’s collecting vessel and the importer’s obligation to receive the exporter’s arriving vessel unloaded), and DEQ (the import clearance obligation on importer i/o exporter).

In addition the new terms has increased the basic understanding of the terms like FOB, CFR and CIF.

(b) These are universal terms and extensively used for the international business they demarcate the areas of responsibilities and define the risks for the exporters and importers, shippers and the insurers, transporters and the warehouses, etc.

These standard trade terms help a trader to quote prices to the importers clearly indicating on following six accounts:

(i) Cost of the goods,

(ii) Insurance,

(iii) Transportation (road, rail, and sea/air),

(iv) Loading and unloading,

(v) Customs clearance, and

(vi) Duties and tariffs.

These terms influence the net price that an exporter can expect and an importer has to pay. Whenever an offer or a contract is to be made these terms are specifically mentioned in very clear ways so there is no ambiguity and no room for any misunderstanding.

How these terms are related in the contract document, is the final verdict and it over rides anything provided in the rules. If due to any reason there is no mention of any specific term than legally it is understood that the contract is on Ex Works.

(c) There are 13 standard INCOTERMS,

1. EXW = Ex Works

2. FCA = Free Carrier

3. FAS = Free Along Side the Ship

4. FOB = Free On Board

5. CFR = Cost and Freight

6. CIF = Cost Insurance and Freight

7. CPT = Carriage Paid TO

8. CIP = Carriage and Insurance Paid To

9. DAF = Delivered At the Frontier

10. DES = Delivered Ex Ship

11. DEQ = Delivered Ex Quay

12. DDU = Delivered Duty Unpaid

13. DDP = Delivered Duty Paid

(d) From the above list you can notice the terms are divided into four groups each starting with a particular alphabet, E-terms(also called the dispatch terms), F-terms (there is no provision for the main carriage), C-terms (in these terms the main carriage is paid up) and D-terms (these are also called the arrival terms).

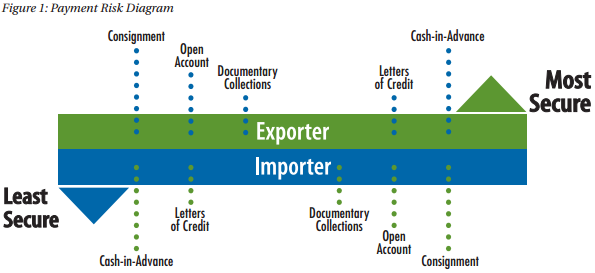

E-terms are the most exporters friendly and D-terms are the most importers friendly. This means for the E-term the exporter has the least risk and the importer has the highest risk. On the other hand for D-terms the exporter has the highest risk and the importer the least.

(e) Explanation on the proportionate degree of risks under four groups.

(f) Explanation on the four deliveries term groups:

E-terms:

This is the most exporter friendly delivery term. The exporter places the contracted goods at the exit point of his premises or any other place indicated by the importer but in close proximity to the exporter’s premises. These goods are not cleared for export but set aside under a commercial invoice favouring the importer, for the export in a way, which is easily identified as such.

The exporter need not arrange the required export license but may assist the importer in doing so but at the risk and cost to the importer. The delivery is done the moment exporter places the goods at the disposal of the exporter at the notified place and time, and duly intimates to the importer for the readiness of the goods to be taken away by the importer.

The loading cost at the exporter’s premises is on importer’s a/c. The risk and costs changes at this moment from the exporter to the importer. The importer has to arrange the export & import licenses, make all the arrangements to insure, collect, clear, arrange carriage and transport the goods from the exporter’s premises (country of origin) up to his premises (country of destination).

F-terms:

These terms are a step further from the EXW in the sense that the exporter’s risk is extended from his premises to the loading point which can be his premises or the loading port, but he is expected to clear and hand over the goods to the importer’s nominated carrier (export license and customs to exporter’s a/c).

The importer is fully responsible to take the goods from the loading point or the port, pay for the carriage and insurance up to his premises. The risk shifts from the exporter to the importer the moment importer takes possession of the goods.

In the case of FCA exporter’s obligations are limited to handing over the goods to the importer’s carrier. The exporter arranges the export license, clears the goods for export and hands over to the importer at the specified named carrier and place where the risk and costs get transferred from the exporter to the importer.

The contract for carriage and insurance is not the responsibility of the exporter, but he may render this service at the risk and cost to the importer. This term is useful for all modes of transport.

In the case of the FAS, the place of delivery is fixed as the importer’s nominated vessel at the loading port. The exporter clears the goods and places them alongside the named vessel and place at the named port in the country of shipment, where the risk and costs shift from the exporter to the importer.

The importer must pay for loading the cargo in the nominated vessel, obtain the import license and arrange for the insurance and carriage up to unloading port and/or his premises in the importing country. This term is used for maritime transport.

In the case of the most extensively used FOB term, the exporter has to obtain the export license, clear the goods for export and load them on board the named vessel under notification to the importer. The moment the goods pass the ship’s rail the risk and cost is transferred from the exporter to the importer and the delivery is said to be done.

The exporter has no responsibility for the contract of carriage and insurance from the moment the goods are loaded into the nominated vessel. If however he has to render this service than it would be to the risk and cost to the importer.

The importer has to get the import license, take the delivery of the goods at the loading port on board the nominated vessel, arrange the insurance and carriage up to the port of destination, or his premises/warehouse, and take away the goods after customs clearance, in the importing country.

C-terms:

There are four terms under this heading (CFR, CIF, CPT, and CIP). Under these terms the exporter is responsible with respect to all actions required to export the goods and the importer is responsible to with respect to all the actions for importation of the goods.

The CIF and CFR are used exclusively for the sea transportation between the loading port and the unloading ports. The other two terms CPT and CIP are used for any mode of transport including the Multimodal transportation, more for the latter case. In this group the destination port is always mentioned but not the loading or original port of loading.

This possess little discomfort for the exporter since he has to get the insurance coverage for the transit period from the point of origin to the point of destination. Under C-Terms the delivery is done and risk shifted once the goods have been shipped on board the vessel, but the exporter has to pay for the sea carriage and insurance but he does not take the risk during the period the goods are in the possession of the carrier.

In the case of CFR the exporter has to obtain the export license, clear the goods from customs and bear the freight up to the destination port but the risks are transferred to the importer the moment the goods pass the ship’s rail at the loading port.

In this case the importer has to clarify at the time of contract formation as to what sort of vessel is to be arranged by the exporter. If left to the exporter he might engage the least costly means (break-bulk carriers or non-liner vessels rather than the liner vessels or even the container vessels).

The importer has to clarify also whether he intends to use containerized cargo or bulk cargo since freight rates are different in both the cases. This term is used for the maritime transport.

After Fob, CIF is the most used shipping term in the international cargo transport, in this case the risks and responsibilities are the same as those of the CFR but the exporter additionally procures and pays for the marine insurance cover. The unloading costs are to be mutually sorted at the time of the contract formation.

The CPT is used for the general and containerized cargo for the Multimodal transport. The exporter pays for loading and the carriage up to the named destination port but the risk passes from the exporter to the importer the moment exporter hands over the goods to the first carrier (in case more than one carrier is used).

The importer in this case accepts the goods the moment exporter hands over to the first carrier. Operationally this term is similar to the maritime term CFR.

Lastly in the case of Multimodal term CIP (which is similar to the CIF maritime term) the exporter pays for the loading (unloading negotiable), carriage and insurance up to the named destination port but the risk passes from the exporter to the importer the moment the cargo is delivered to the first named carrier by the exporter.

The importer has to accept the goods the moment exporter hands them over to the first carrier. This term CIP differs from the CPT only in the sense that under CIP the exporter must arrange for the cargo insurance policy and his risk for any loss or damage to the goods is extended till the agreed point and place of delivery, as decided by the importer.

D-terms: Under D-terms (except DDP) the importer has to undertake all the actions required for importation in his country. The exporter bears all the risks and costs till the goods are placed at the delivery point the importer have selected.

In D-terms there are five variants (DAF, DES, DEQ, DDU, and DDP). DES and DEQ are used for sea transport, DDU and DDP for all modes of transport, and DAF for rail transport where delivery of goods is destined at the frontier post.

These terms are generally used for the manufactured goods where the manufacturer and/or the trader wants to exercise direct control over the movement of the goods, and also to help his distributors in the target market to fight competitively with the competitors, besides when the manufacturer wants to have full control over the way his cargo is loaded, shipped on board, and unloaded at the destination port.

In the case of DAF the exporter makes the custom clearance and places the goods at the named place on the road/rail point for the importer to take possession, the risk is also transferred at this point from the exporter to the importer.

In the case of the DES the exporter clears the goods from the customs, pays for the freight and insurance and puts them on board the named vessel up to the destination port where goods are available to the importer on board the vessel.

The risk shift point occurs at the moment cargo is placed on board the carrier at the destination port and at the point of unloading as agreed upon with the importer. The importer has to unload and make arrangements for clearance of the goods at the destination port.

DEQ is one step further to DES; in this case the exporter has to get the Export license pay all the dues at the loading port. The importer has to get the import license and clear the goods at the destination port and pay taxes as applicable at the unloading port. The risk shift over point occurs the moment importer takes the delivery of the goods at the quay of the named port of destination.

In the case of DDU the exporter should deliver the goods at the selected place on the named port, bearing all the costs up to that point, and the importer has to do the custom clearance, pay the duties, and bear the expenses for unloading and taking possession of the goods.

The risk changes at the destination port, from the exporter to the importer, when the exporter hands over the goods at the destination port and place to the importer.

Lastly in the case of DDP the exporter bears all the risks and costs and clearances for making the goods available to the importer at the named port exit point and place for the importer to unload and take possession and move away with the goods.

In this case the local taxes as applicable in the destination country (the country of the importer) are excluded from the exporter’s responsibility, but a clause has to be added in the contract.

The risk shift point occurs when the exporter places the goods at the disposal of the importer at the exit point at the destination port at the importer’s collecting vessel/vehicle in unloaded condition. The unloading is importer’s responsibility.

(g) Extensions:

Sometimes a rider clause is attached to cover additional risks. Like CIF is a delivery term specifying that the cost insurance and freight is covered in the offered prices. But in a war like situation in any part of the globe a rider clause can be added to it to cover the additional risk.

Like CIF + war risk insurance, or in the case of bulk cargoes this term can be further modified like CIF FO, the term FO means FREE OUT that is the charges for unloading the bulk cargo from the ship on to the docks.

There is another variant which can be attached to any term it is coded as “C” meaning commission to be paid to the trader and the term is mentioned as FOBC3 or CIFC3, the fig 1 indicates that the price is inclusive of 3 % commission for the trader involved.

(h) The Incoterms are not the Law:

These terms in themselves are not the law, but when accepted by both the importers and the exporters, than it become the legal document and can be taken up for redressal in a court of law.

(i) Usage:

Specific usage of the specific terms.

(a) FCA, CPT. and CIP are used for the general, Multimodal/Containerized transport.

(b) FOB, CFR, and CIF are used for the maritime transportation.

(j) Basic Terminology:

There are some basic terms used in the transaction or carriage of the goods, like;

Contract:

This document specifies mainly the item, quantity, specification, price, delivery time and payment terms binding on the buyer and the seller.

Country of Origin:

This indicates the country in which the goods are produced and or from which the seller has to dispatch them.

Carrier:

This term specifies the owner/charter who enters into a contract of carriage with a shipper. It also includes the mode of transport to be used i.e. road, rail, air or sea.

Expenses:

This term indicates as to who bears the costs involved up to the carriage, for the carriage and after the carriage.

Insurance:

This means the insurance cover during the period the goods are in transit from the point of origin up to the point of destination.

Commercial Invoice:

This document pertains to the authentication for the sale of goods from the exporter to the importer.

Bill of Lading:

This is the key document for the conduct of export trade. It links up the goods, payment, and the carrier under a contract.

This document, in its negotiable form, is very important for the related bankers for them it is their security for the credit amount, however when it is in non- negotiable form then it serves no security to the related bankers unless they are named as consignee and they take steps to ensure that this designation in irrevocable.

This refers to a document issued by or on behalf of the carrier as an evidence of contract of carriage as well as the proof of the goods on board the carrier or on board. This document also transfers the ownership of the contracted goods from the seller to the buyer and this document also enables the buyer to release the payment to the seller in a way as defined in the contract document.

(k) Different Forms of Bill of Lading:

According to ICC guidelines, the various forms of the B/L are as follows:

(i) On-Board/Shipped B/L:

A B/L confirming that the cargo is on board the ship in good condition.

(ii) Received for Shipment B/L:

It only signifies that the goods have been received but not loaded on board. It is common with the container shipments delivered to ports terminals. In this case the B/L must be converted by subsequent ON-BOARD notation if circumstances so warrant.

(iii) Clean B/L:

It is a B/L, which contains no mention indicating that the goods have been wholly or partially lost/damaged.

(iv) Dirty/Foul/Claused B/L:

It is a B/L, which contains a mention that the goods have been partially or wholly lost or damaged.

(v) Straight B/L:

It is a non-negotiable B/L, consignee only needs to identify himself to pickup the goods.

(vi) Order B/L:

It is a negotiable B/L issued – to the order- of a specific party, which is commonly the shipper.

(vii) Through B/L:

It is a B/L used when the shipment will involve multiple transport stages involving different carriers.

(viii) Direct B/L:

It is a B/L for direct transportation between loading and discharging ports.

(ix) Multimodal B/L:

It is also called the combined transport B/L. It is issued to cover transport- involving variety of transportation mediums like road, rail, sea/air rail and road respectively involving the destination point.

(x) Fiata FBL:

It is a standard for of B/L issued by a freight forwarder; considered under UCP 500- along with other forwarder bills in which the agents accept full responsibility as a cameras acceptable as a clean on board B/L issued by a career.

(xi) House B/L:

A B/L issued by freight forwarder in his own name covering the group of consignments.

(xii) Freight Pre Paid B/L:

It indicates that the shipper has paid the freight.

(xiii) Liner B/L:

A B/L, which is subject to the terms and conditions of a shipping line.

(xiv) Short-Form B/L:

In this case the B/L does not contain the full terms and conditions of the contract carriage. Instead it contains an abbreviated version of the carrier’s conditions with a reference to the full set of the conditions.

(xv) Stale B/L:

The B/L must be presented within a prescribed number of days. A B/L, which is presented not with the specified date, is called Stale B/L.

(xvi) Waybill:

It is a non-negotiable transport document.

Shipment and Arrival Contracts:

There are two types of contracts for the international trade. The Shipment Contracts and the Arrival Contracts.

Shipment Contracts:

The E, F and C terms (EXW, FCA, FAS, FOB, CFR, CIF, CPT, and CIP) are called the shipment terms since the exporter transfers the risks to the importer after he has shipped the goods or placed them at the disposal of the importer. The contracts thus entered into between the importers and the exporters are termed as the “shipment contracts”.

Such contracts are tilted towards the exporter since he gets away from the risks of the high seas. If the cargo is lost in transit then the exporter has no obligation towards the importer and the importer has to get compensation from the insurance company, extent of which would depend 011 the type of cover that he had taken for his consignment.

The system of the documentary credit has its roots in this type of business transactions. In shipment contracts the delivery takes place in the country of the exporter. If the exporter arranges for the insurance cover even than it does not mean that he undertakes the delivery obligation upto the destination point.

His risk and obligations finishes at the point of delivery as covered under the shipment terms. In such cases the resulting losses or damage to the goods (in transit) has to be the responsibility of the importer.

For safety sake the exporter may insist upon inclusion of specific clause in the delivery terms (in the event he arranges for the insurance) that resulting losses and damage to the goods after they have passed the delivery point must rest with importer.

Arrival Contracts:

The D-terms (DAF, DES, DEQ, DDU, and DDP) are also called the arrival terms since they mean that the goods are delivered at the discharging port of the importer by the exporter. The contracts thus entered using these D-terms are called as the “arrival contracts”.

In these contracts the exporter is fully responsible till the goods are delivered at the named port of the importer, so he (exporter) assumes total risk for the goods during the transit period from the shipment port to the destination port.

If the goods are lost during transit then he is legally bound to replace and/or compensate the importer to the extent the damage has occurred. It is a different matter that the exporter in such cases will get compensation from the insurance company. The most important point is at which stage the risk got transferred from the exporter to the importer.

There are two critical points, one at which the division of the risk takes place, one at the loading port when the goods pass the rail of the ship and second when the goods arrive at the destination port. The exporter has paid for the carriage till the destination port, so it is natural that he bears the risk from the time the goods pass the rail of the ship to till the destination port.

DDU is in contrast to this. In this case the exporter bears full risk till the goods are delivered at the destination port. If the goods are lost or damaged in transit than the exporter must replace them or compensate the importer. It must be noted that in the arrival contracts the delivery takes place in the country of the importer.

The Various Cost Headings:

The movement of the goods from the exporter’s premises up to the importer’s premises involves various cost heading; some are to be borne by the exporter and the others by the importer. The net sum of the total cost heads is fixed, if it increases for one party, it decreases for the other party.

As we move from the EXW to the DDU the net cost headings and the cost to the exporter increases and proportionately it decreases to the importer but it doesn’t mean that the importer pays less or the imports gets more. As far as the importer is concerned the net cost of the goods to him is the total cost-heads of all the individual elements.

On the other hands the net cost to the exporter is the cost of his goods on EXW basis and that is what he wants to get paid for but if he performs any additional activity than he charges it to the importer. For a better understanding of the INCOTERMS we must understand these cost heads.

General Actions Done in the Country of Origin and Destination:

(i) Loading Port/Country of Origin:

1. Cost of the goods (material cost, processing cost, overheads, internal inspection, packing material, packing, and profit margins).

2. Cost for arranging export license.

3. Cost of documentation.

4. Cost of the 3rd party inspection

5. Arrangement for Insurance cover.

6. Contract for carriage and dispatch. (Always Exporter’s except EXW)

7. Arrangement for main sea carriage.

8. Cost of inland transport up to the loading port.

9. Port charges.

10. Customs clearances.

11. Loading into the vessel.

(ii) Unloading Port Activities/Country of Destination:

12. Payment to the exporter.

13. Arrange for the import license

14. Port charges.

15. Unloading at the destination port.

16. Import duties and taxes.

17. Local transport

(ii) The division of the costs between the exporter and the importer depends on the specific delivery term used in the contract. In the table following hereunder the various cost heads are listed against the respective delivery term for exporter’s a/c. What is not mentioned for the exporter will be for the importer a/c.

The Risk Shift Points under Various Delivery Terms:

The risk shifts from the exporter to the importer when the delivery of the goods under the contract has been done as per the contract and the moment importer takes over the possession of the goods the risk shifts from the exporter to the importer.

As such when discussing the risk transfer factor take the delivery and possession points in to consideration.

In the following paragraph such risk transfer points are mentioned for the easy understanding of the students:

(i) EXW:

The exit point of the exporter’s premises.

(ii) FAS:

Loading port, at the wharf.

(iii) FOB:

Ship’s rail at the loading port.

(iv) FCA:

Delivery of the goods to the nominated carrier at the loading port.

(v) CFR:

Ship’s rail at the loading port.

(vi) CIF:

Ship’s rail at the loading port.

(vii) CPT:

Delivery to the nominated carrier (or first carrier in case more than one).

(viii) CIP:

Delivered to the nominated earner (or Is’ carrier in case more than one).

(ix) DAF:

The frontier customs exit point of the exporter’s country.

(x) DES:

Onboard the exporter’s carrier, at the unloading port.

(xi) DEQ:

On the quay at the unloading port.

(xii) DDU:

The selected point and place by the importer for taking delivery.

(xiii) DDP:

The selected point and place by the importer for taking delivery.

Insurance Obligations under Incoterms:

The terms CIF and CIP clearly stipulates the insurance obligations under the INCOTERM but even under these terms the exporter takes out the insurance policy on the minimum terms, and leaves it up to the importer to get extra policy cover at his (importer’s) own a/c.

As far as the EXW is concerned there is no need for the exporter to get any cover but it is for the importer to get full cover from the exporter’s premises up to the destination point or his premises.

Similarly for DDP (reversal of EXW) the importer has to take out policy to the extent the goods are in his possession after delivery, but the exporter has to get the full cover from his premises up to the destination point (port terminal or premises) in the importer’s country.

For the rest of the 9 terms it is left to the parties to decide on mutual consultation, or otherwise, how to safeguard their interests against the loss and damage to the goods. Here again they may take out policies at least up-to-the-point/from-the-point of risk respectively.

Sale of Goods in Transit:

In case the importer intends to sell the contracted goods in transit, than normally he o uses the CFR or the CIF terms. Because in these two terms the exporter ships the goods after concluding the carriage contract with the carrier, thereby getting the B/L which can be used by the exporter for sale in transit. In this case the importer becomes the exporter and the first party, which buys the goods, becomes the importer.

It must be noted that in case of sale in transit, the goods are still on board the vessel and the first party, or any number of subsequent parties, cannot know the condition of the goods, but since the carrier issued the clean transport documents after accepting the goods on board from the exporter, it is understood that the goods were in good condition.

So the importer’s interests are protected against the loss or damage to the goods by the issuer of the transport documents.

Transfer of Risk and Transfer of Property Rights:

These are two different terms, risk relates to the loss and damage to the goods, rights relates to the ownership to the goods. Transfer of risk occurs when the goods are delivered to the importer dependant on the specific delivery term used for the transaction.

It is possible that the exporter retains the title to the goods even after the risk has been shifted to the importer, but the moment the importer releases the payment to the importer, he (importer) assumes the title to the property (goods) and the property right are shifted from the exporter to the importer.